Digitization and automation are bringing forth paradigm shifts in every field it touches. The Chartered Accountant (CA) profession is not an exception. The advancement of technology has opened up various innovative avenues, as CAs are gearing up towards Digital Practice. One such novel opportunity for CAs in practice is “Virtual CFO”.

What is Virtual CFO?

Simply put, Virtual CFO is the concept where the functions of a CFO in a Company are outsourced to a Finance Professional. Thus, a business can avail of the benefits of a CFO, without needing to hire a full-time CFO. This specifically applies to the prevailing times where we witness mushrooming start-ups and MSMEs.

The services provided by a Virtual CFO are not only limited to recurring accounting & taxation matters but also encompasses advisory in strategy & policy formulation and non-recurring matters such as mergers, restructuring, acquisition, etc.

Why Chartered Accountants are a perfect fit as Virtual CFOs?

The Role of a CFO has seen a transformation over the past years and now encompasses several fields aside from traditional finance and accounts. It includes analyzing and dealing with the business environment as a whole. This is where the expertise of a Chartered Accountant plays a vital role. Awareness and the economy and financial foresight of a CA is an added benefit.

A Chartered Accountant, as a Virtual CFO also brings independence and integrity which become essential in decision-making aspects.

It is important that a CA is backed by adequate technology to provide the right service to Clients at the right time. Digitization will help Chartered Accountants to automate recurring work-intensive activities and focus on improving the efficiency and productivity of the Team.

Virtual CFO represents a tremendous opportunity to practicing CAs and it is critical that the potential is tapped at the right time.

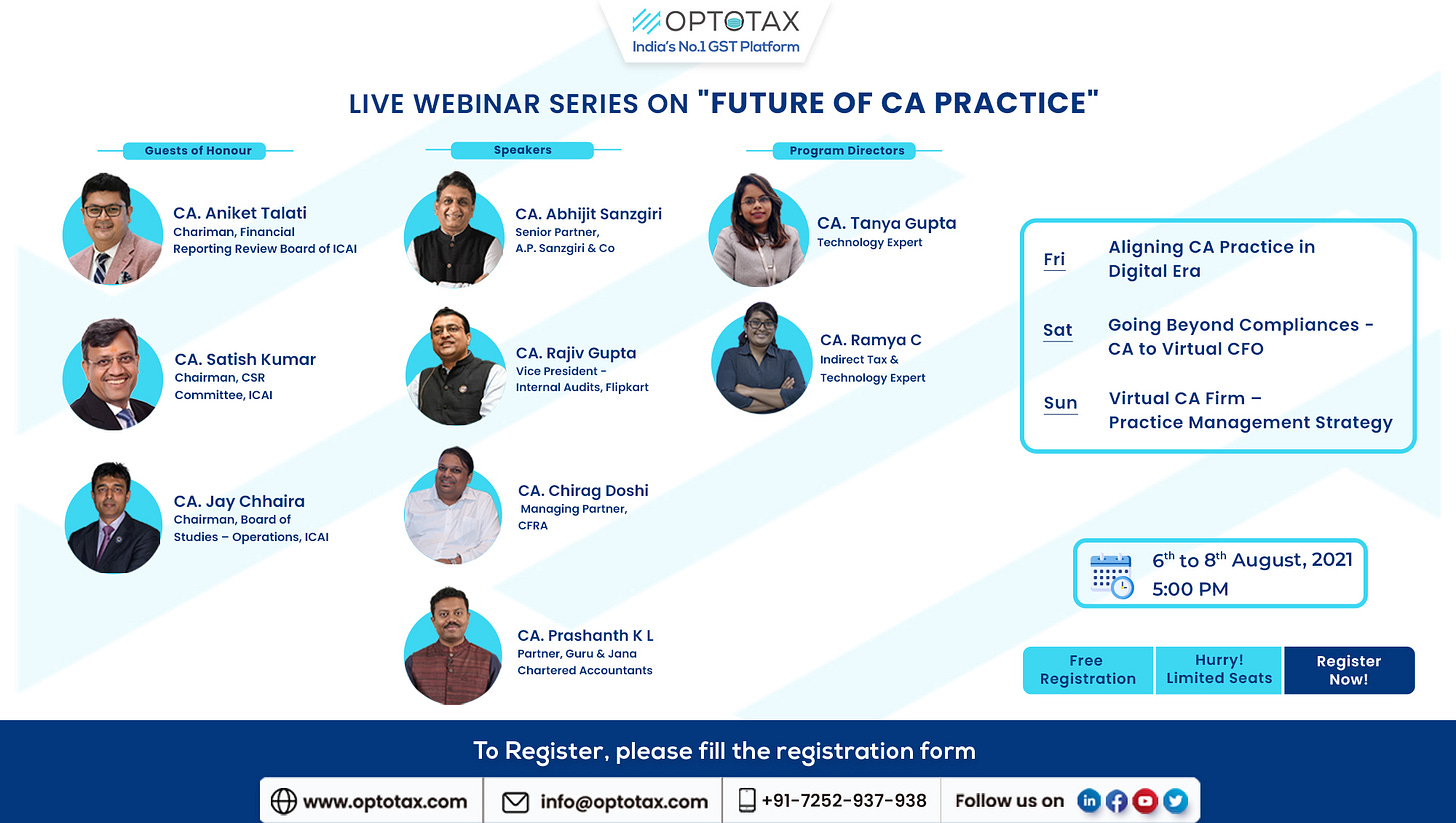

For a more practical perspective about the Virtual CFO & digital revolution of CA practice, join the Live Webinar Series on “Future of CA Practice” where renowned professionals share their experience, guiding towards aligning CA Practice with changing times and new opportunities available for CAs.

Registration Link: https://opto.tax/liveseries-b

What are the Domains where a CA can provide Virtual CFO Services?

Services provided by a Virtual CFO, being comprehensive, comprises of a wide variety of domains which inter alia includes:

Formulation of Strategies and Policies: A Virtual CFO participates in Board Meetings and other Executive Meetings for providing an Expert’s perspective in devising Long-term Business Plans. A Virtual CFO also advises in the formulation of policies and procedures such as manpower, ERP, IT Controls, payrolls, etc.

Finance & Accounts: This includes periodical reviews of Balance Sheet and Profit & Loss Accounts, cash flows, review of MIS, borrowings, and interactions with Government Authorities.

Tax & Legal Compliances: A Virtual CFO would also provide services for compliances under tax laws such as GST and Income Tax (Return filing, advisory, etc). It would also include compliances under other laws such as the Companies Act, MSME Act, Factories Act, etc.

Advisory for Special Transactions: A CA may also provide services as a Special Purpose Virtual CFO which would be limited to a certain period or a particular transaction such as a merger, demerger, acquisition, etc.

To conclude, Virtual CFO represents a contemporary and innovative opportunity for Chartered Accountants to grow their practice. Virtual CFO takes the utmost advantage of technology and automation and provides the best value to clients and opens up new areas of practice.

Optotax is a Technology Platform Trusted by 50,000+ Tax Professionals across the Country for their 1 Million+ Clients.

Optotax is India’s No. 1 GST Platform and is Exclusively Free for all Tax Professionals.

Our mission is to Empower Tax Professionals and Simplify their practice.

To achieve our mission, we provide a single platform where the Tax Professionals can manage their compliance work in a simplified manner and also gets the opportunity to learn and upgrade knowledge with the help of knowledge-sharing webinars conducted by the best faculties across the country, Taxation related updates, Newsletters, Blogs, Articles, etc.