“Change before you have to” – Jack Welch

This quote aptly summarises the current circumstances that we are in, especially post the pandemic and lockdown. These times have brought immense changes, be it Work from Home till the emergence of new arenas like Virtual CFO. This has compelled the citizens, Government, and even the Judiciary to go digital and perform activities from remote locations.

Technology & Digitisation has opened various avenues for professionals such as Virtual CFO, Information System Audits, and even services for assistance during the development/implementation of software in a Company. Further, technology also aids in streamlining & optimizing day-to-day tasks which will consequently improve the quality of services provided to clients and efficiency in utilizing resources.

In this article, let’s discuss the impact & potential of digitization in various facets of a CA practice, which tapped by being proactive opens up new avenues for professionals.

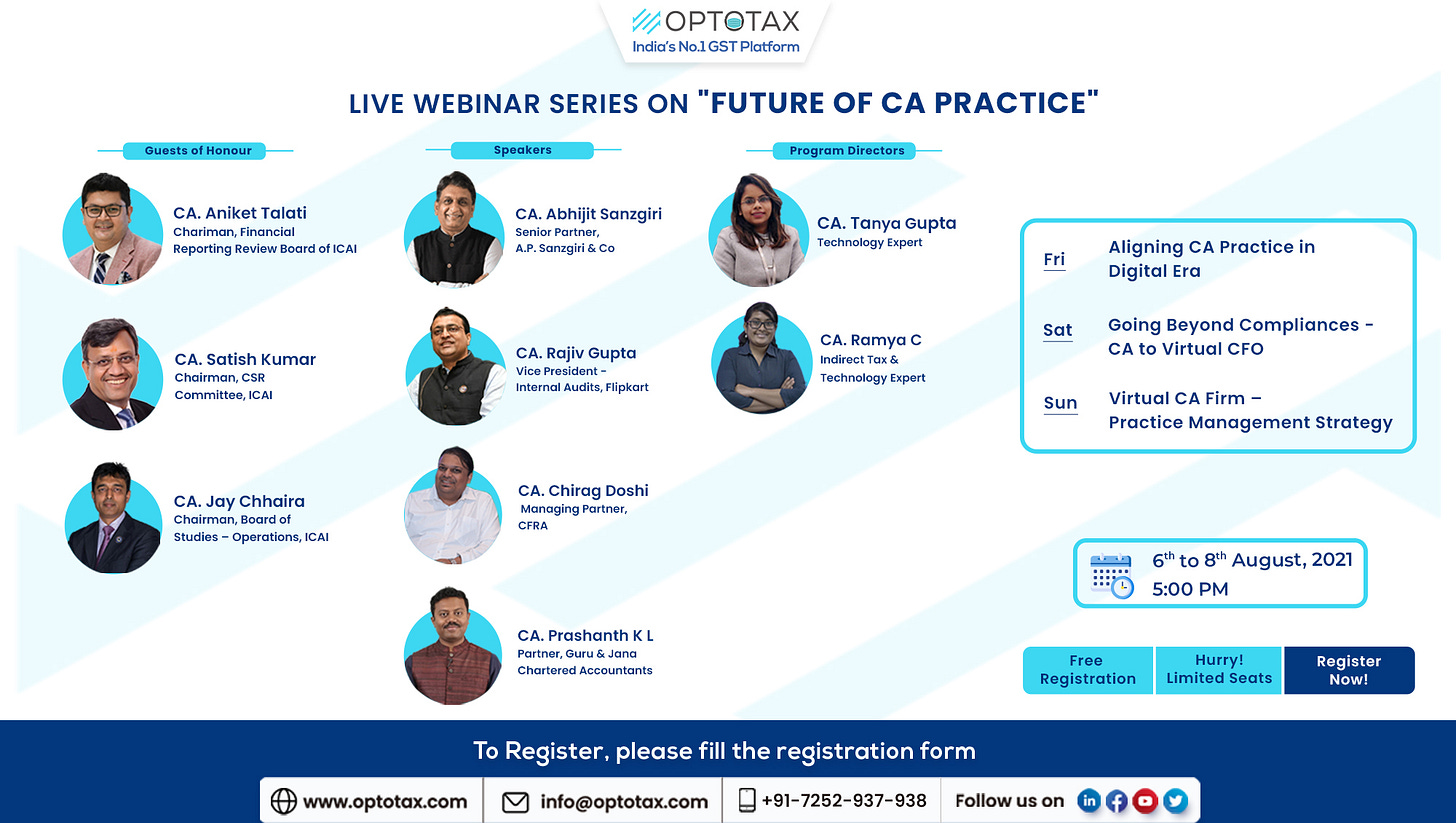

For a more practical perspective about the digital revolution of CA practice, join the Live Webinar Series on “Future of CA Practice” where renowned professionals share their experience, guiding towards aligning CA Practice with changing times and new opportunities available for CAs.

Registration Link: https://opto.tax/liveseries-b

Networking & Communication

We have been witnessing a shift from traditional mortar offices to modern virtual offices. Physical places have become secondary and meetings in client offices have drastically reduced, replaced by calls over Zoom or Google Meet. Here are various facets of Communication involved:

1. Communication with staff/employees: Where all or part of the employees works remotely, the need for effective communication becomes significant. In order to ensure smooth flow of work and maintaining the quality of work delivery, it is necessary that proper Practice Management System (PMS) is established. An online PMS increases the effectiveness of service delivery as well as streamlining of day-to-day tasks.

2. Communication with Clients: Meetings with Clients are now happening online, over platforms such as Google Meet or Zoom. Selection of the right platform for meetings and other written communication is important to ensure confidentiality. This includes sharing of documents between the firm and clients, making sure the online depository for documents is protected from tampering & cyber-attacks.

3. Communication with Government Authorities: The pandemic has forced the judiciary to go online and hearing often happen online. For this, a CA should establish the right platform to maintain the confidentiality of information shared and representations made before the Authorities.

Document Management:

Among the enormous amounts of documents received and shared by practicing professionals, it is critical that a robust document management system is put in place to ensure the completeness and integrity of documents are maintained.

1. Client-related documents: Documents received/shared or working papers relevant to clients need to be maintained with the utmost confidentiality. It requires strong passwords and firewalls for protection from cyber-attacks and misuse of information.

2. Inter-office documents: Inter-office documents range from employee information, bank statements, draft working papers for partner finalization, etc. Streamlining of processes and location of documents is important and can be established through Document Management System.

Accounts & Receivables:

It is seen that employees in a practicing firm spend quite a lot of time on client payment follow-up and reconciliations, which are primarily still done manually. Digitization of these tasks provides leeway for improving the productivity of employees and efficient utilization of time by both employees and partner/manager.

Further, automation of accounting and automatic updation of payment status through the utilization of robust accounting platform, accessible to partners on a near real-time basis.

To conclude, it is crucial that practicing Professionals pro-actively analyze their existing and potential scope of practice which can be undertaken through digitization. Tremendous opportunities are opening up for Chartered Accountants with the looming digital era and tapping it at the right time will help boost the growth of CA practice.

Optotax is a Technology Platform Trusted by 50,000+ Tax Professionals across the Country for their 1 Million+ Clients.

Optotax is India’s No. 1 GST Platform and is Exclusively Free for all Tax Professionals.

Our mission is to Empower Tax Professionals and Simplify their practice.

To achieve our mission, we provide a single platform where the Tax Professionals can manage their compliance work in a simplified manner and also gets the opportunity to learn and upgrade knowledge with the help of knowledge-sharing webinars conducted by the best faculties across the country, Taxation related updates, Newsletters, Blogs, Articles, etc.