PoEM

CA. Meenu Agarwal

PoEM – which poem am I referring to here? Is it a poem that a poet writes describing his feelings and ideas about something – of course NOT.

The PoEM I am referring to here is called “PLACE OF EFFECTIVE MANAGEMENT”. PoEM helps to determine the residential status of a company. Let’s understand few important terms before deep diving into PoEM.

Is Company defined under Income Tax Act (“the Act”)?

As per Sec 2(17) of the Act defines company as -

“ "company" means—

(i) any Indian company, or

(ii) any body corporate incorporated by or under the laws of a country outside India, or

(iii) any institution, association or body which is or was assessable or was assessed as a company for any assessment year under the Indian Income-tax Act, 1922 (11 of 1922) or which is or was assessable or was assessed under this Act as a company for any assessment year commencing on or before the 1st day of April, 1970, or

(iv) any institution, association or body, whether incorporated or not and whether Indian or non-Indian, which is declared by general or special order of the Board to be a company :

Provided that such institution, association or body shall be deemed to be a company only for such assessment year or assessment years (whether commencing before the 1st day of April, 1971 or on or after that date) as may be specified in the declaration”

H0w to determine the residential status of a company in reference to the Act?

Section 6(3) of the Act states the conditions that need to be fulfilled by the company to become resident in India -

“A company is said to be a resident in India in any previous year, if—

(i) it is an Indian company; or

(ii) its place of effective management, in that year, is in India.”

What is the meaning of Place of effective management or PoEM?

As per Explanation to Sec 6(3) of the Act -

“place of effective management" means a place where

key management and commercial decisions

that are necessary for the conduct of business of an entity as a whole are, in substance made”

When were the provisions of PoEM introduced in India?

PoEM was introduced vide Finance Act 2015, effective from April 1, 2016, however, there were certain changes in effectivity that were introduced vide Finance Act, 2016 and thus PoEM was made effective from April 1, 2017, i.e., from Assessment Year (“AY”) 2017-18 and subsequent assessment years.

Whether the concept of PoEM is a new term introduced for determining the residential status of a company?

PoEM is an internationally recognized test for the determination of residence of a company incorporated. Most of the tax treaties entered into by India recognise the concept of 'place of effective management for determination of residence of a company as a tie-breaker rule for avoidance of double taxation.

What is the process to apply PoEM?

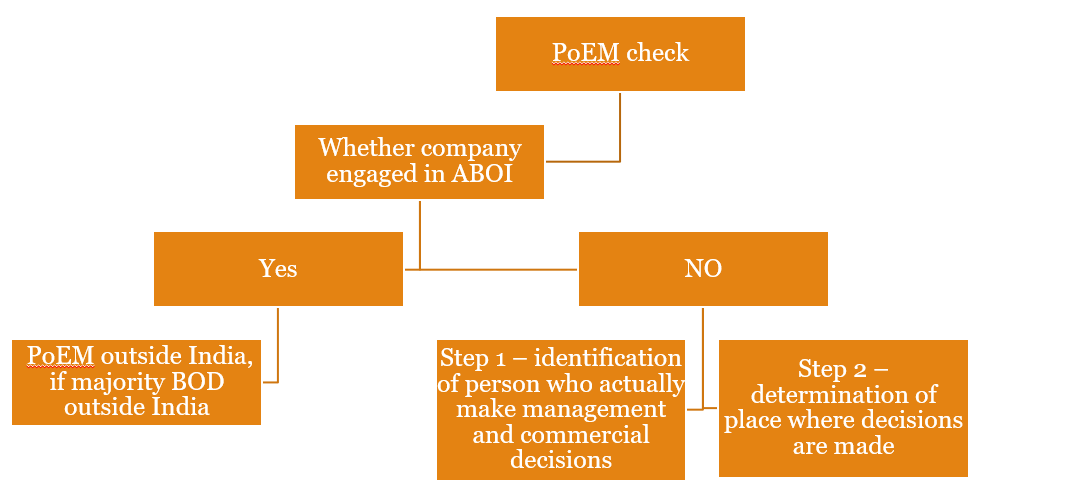

Vide CBDT circular 6/2017, guidelines are outlined below for PoEM check:

What is ABOI?

ABOI stands for “ACTIVE BUSINESS OUTSIDE INDIA”

How to determine “ABOI”?

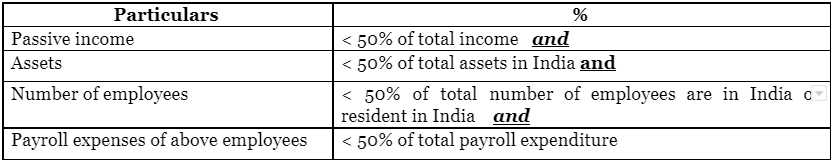

ABOI shall be determined as below:

What is the frequency of determination of PoEM?

PoEM to be determined every year.

What is the basis for arriving at ABOI?

ABOI to be calculated as the average of previous year + 2 years prior data.

If the company is in existence for a shorter period, then data of such period to be considered.

Define passive income for ABOI?

Passive income of a company shall be aggregate of –

i) income from the transactions where both the purchase and sale of goods is from/to its associated enterprises; and

(ii) income by way of royalty, dividend, capital gains, interest or rental income

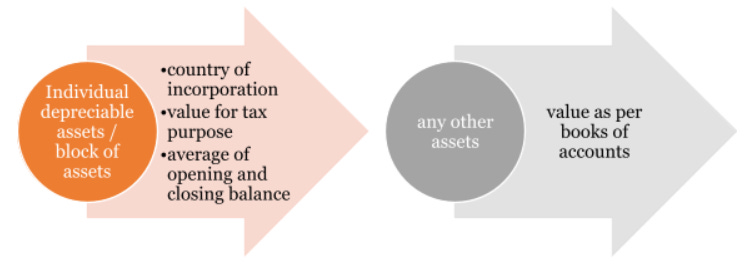

What shall be the value of assets for the purpose of ABOI?

Explain payroll expenses

Payroll expenses include

Cost of salaries

Wages

Bonus

Other compensation benefits

Related pension fund

Social costs borne by the employer

Illustrations:

The following are certain illustrations intended to highlight the applicability of certain principles enumerated in the foregoing paragraphs of the guidelines. The facts assumed have been simplified to highlight the principle. Actual determination of POEM of a company shall depend on all relevant facts.

Case 1: Company A Co. is a sourcing entity, for an Indian multinational group, incorporated in country X and is 100% subsidiary of Indian company (B Co.).

The warehouses and stock in them are the only assets of the company and are located in country X.

All the employees of the company are also in country X.

The average income wise breakup of the company’s total income for three years is, -

(i). 30% of income is from transaction where purchases are made from parties which are non-associated enterprises and sold to associated enterprises;

(ii). 30% of income is from transaction where purchases are made from associated enterprises and sold to associated enterprises;

(iii). 30% of income is from transaction where purchases are made from associated enterprises and sold to non-associated enterprises; and

(iv). 10% of the income is by way of interest.

Solution: In this case, passive income is 40% of the total income of the company.

The passive income consists of, -

(i). 30% income from the transaction where both purchase and sale is from/to associated enterprises; and

(ii). 10% income from interest.

The A Co. satisfies the first requirement of the test of active business outside India. Since no assets or employees of A Co. are in India the other requirements of the test is also satisfied. Therefore, company is engaged in active business outside India.

Case 2: The other facts remain the same as that in Case 1 with the variation that A Co. has a total of 50 employees.

47 employees, managing the warehouse, storekeeping, and accounts of the company, are located in country X.

The Managing Director (MD), Chief Executive Officer (CEO), and sales head are residents in India.

The total annual payroll expenditure on these 50 employees is Rs. 5 crore.

The annual payroll expenditure in respect of MD, CEO, and sales head is Rs. 3 crore.

Solution: Although the first limb of the active business test is satisfied by A Co. as only 40% of its total income is passive in nature.

Further, more than 50% of the employees are also situated outside India.

All the assets are situated outside India.

However, the payroll expenditure in respect of the MD, the CEO and the sales head being employee’s resident in India exceeds 50% of the total payroll expenditure.

Therefore, A Co. is not engaged in active business outside India.

Case 3: The basic facts are the same as in Case 1.

Further facts are that all the directors of the A Co. are Indian residents.

During the relevant previous year, 5 meetings of the Board of Directors is held of which two were held in India and 3 outside India with two in country X and one in country Y.

Solution: The A Co. is engaged in active business outside India as the facts indicated in Case 1 establish.

The majority of board meetings have been held outside India.

Therefore, the POEM of A Co. shall be presumed to be outside India.

Case 4: The facts are the same as in Case 3 but it is established by the Assessing Officer that although A Co.’s senior management team signs all the contracts, for all the contracts above Rs. 10 lakh the A Co. must submit its recommendation to B Co.

B Co. makes the decision whether or not the contract may be accepted.

It is also seen that during the previous year more than 99% of the contracts are above Rs. 10 lakh and over past years also the same trend in respect of value contribution of contracts above Rs. 10 lakh is seen.

Solution: These facts suggest that the effective management of the A Co. may have been usurped by the parent company B Co.

Therefore, POEM of A Co. may in such cases be not presumed to be outside India even though A Co. is engaged in active business outside India and the majority of the board meetings are held outside India.

Case 5: An Indian multinational group has a local holding company A Co. in country X.

The A Co. also has 100% downstream subsidiaries B Co. and C Co. in country X and D Co. in country Y.

The A Co. has income only by way of dividend and interest from investments made in its subsidiaries.

The Place of Effective Management of A Co. is in India and is exercised by the ultimate parent company of the group.

The subsidiaries B, C and D are engaged in active business outside India.

The meetings of Board of Director of B Co., C Co. and D Co. are held in country X and Y respectively.

Solution: Merely because the PoEM of an intermediate holding company is in India, the PoEM of its subsidiaries shall not be taken to be in India.

Each subsidiary has to be examined separately.

As indicated in the facts since B Co., C Co. and D Co. are independently engaged in active business outside India and the majority of Board meetings of these companies are also held outside India, The PoEM of B Co., C Co. and D Co. shall be presumed to be outside India.

Optotax is a Technology Platform Trusted by 50,000+ Tax Professionals across the Country for their 1 Million+ Clients.

Optotax is India’s No. 1 GST Platform and is Exclusively Free for all Tax Professionals.

Our mission is to Empower Tax Professionals and Simplify their practice.

To achieve our mission, we provide a single platform where the Tax Professionals can manage their compliance work in a simplified manner and also gets the opportunity to learn and upgrade knowledge with the help of knowledge-sharing webinars conducted by the best faculties across the country, Taxation related updates, Newsletters, Blogs, Articles, etc.