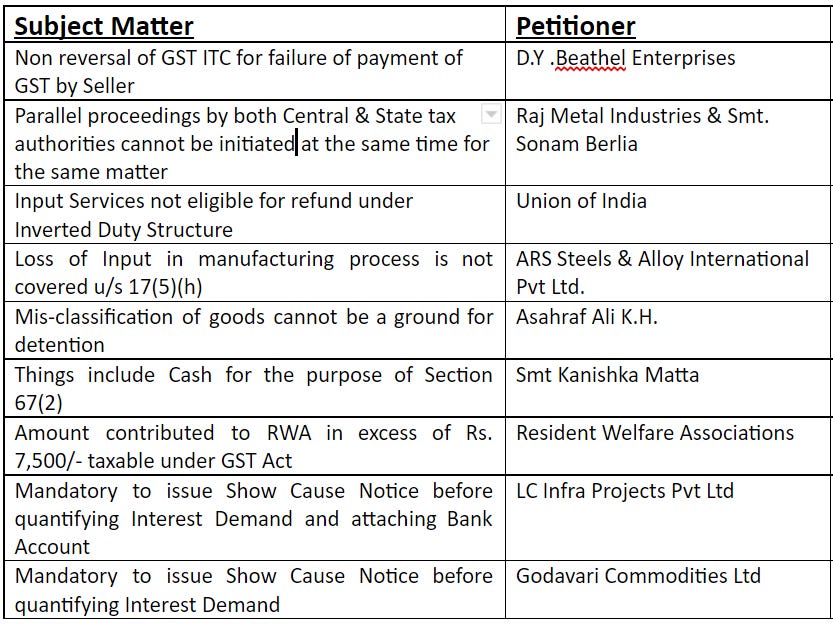

Non-reversal of GST ITC for failure of payment of GST by seller

Petitioner: D.Y.Beathel Enterprises

Respondents: The State Tax Officer, Investigation Wing, Tirunelveli

Authority: Madras High Court

Date: 24th February 2021

Case: The petitioners had purchased goods from Charles and his wife Shanthi and payment (including the tax component) was made to them through banking channels. Based on the returns filed by the sellers, the petitioners availed the Input Tax Credit. However, the sellers didn’t pay tax to the Government which initiated proceedings against the Petitioners. The petitioners submitted that without involving the sellers, the impugned order was passed levying entire liability on the petitioner. A writ petition is filed challenging the Order.

Core Issue: Whether ITC availed by the buyer can be reversed for failure to pay tax by the seller?

Court’s Observation:

Attention of the Court was drawn to the decision of Madras High Court made in Sri Vinayaga Agencies Vs. The Assistant Commissioner, CT Vadapalani. It was held that the authority does not have the jurisdiction to reverse the Input Tax Credit already availed by the assessee on the ground that the selling dealer has not paid the tax.

Press release issued by Central Board of GST Council on 04.05.2018 was referred to wherein it has been mentioned that there shall not be any automatic reversal of input tax credit from buyer on non-payment of tax by the seller. In case of default in payment of tax by the seller, recovery shall be made from the seller. Reversal of credit from buyer shall be an option only to address exceptional situations like missing dealer, closure of business by the supplier or the supplier not having adequate assets etc.

On examining Sec 16(1) & (2) of the GST Act, it is clear that the assessee must have received the goods and the tax charged must have been actually paid to the Government.

If the tax had not reached the kitty of the Government, then the liability may have to be eventually borne by either the seller or the buyer. However, where it has come out that the seller has collected the tax, any omission on part of the seller must have been viewed very seriously and strict action ought to have been initiated against the seller.

The respondent does not appear to have taken any recovery action against the sellers.

Judgement: The impugned order suffers from certain fundamental flaws and is quashed for the following reasons:

Non-examination of sellers in the enquiry

Non-initiation of enquiry action against sellers in the first place

The Court also directed to hold fresh enquiry where the sellers shall be examined as witnesses. Parallelly, the respondent will also initiate recovery action against the sellers.

Parallel proceedings by both Central & State tax authorities cannot be initiated at the same time for the same matter

Petitioner: Raj Metal Industries

Respondents: Union of India & State GST

Authority: Calcutta High Court

Date: 24th March 2021

Case: The petitioner received a summons by the State GST Authorities on the same subject matter initiated by the Central GST Authorities. The e-credit ledger of the petitioner was blocked u/s 16(2)(c) read with Rule 86A.

Core Issue: The petitioner challenged:

The vires of Rule 86A of the CGST Rules / WBGST Rules and Section 16(2)(c) of the CSGT Act / WBGST Act;

The blocking of e-credit ledger; and

The actions initiated by State GST authorities with respect to the summons issued.

Court’s Observation:

As per Section 6(2)(b) of the WBGST Act, where a proper officer under CGST Act has initiated any proceedings on a subject matter, no proceedings shall be initiated by the proper officer under State GST Act on the same subject matter.

Clarification has been issued by CBIC that if an officer of central tax authority initiates intelligence-based enforcement action against a taxpayer who is administratively assigned to the state tax authority; the officers of central tax authority would not transfer the case to the state tax counterpart and would themselves take the case to its logical conclusion.

Judgement:

The summons issued by State GST is in violation of Section 6(2)(b) of WBGST Act. It is therefore directed to stay the summons and any proceedings thereunder.

Blocking of e-Credit ledger ha been done by the state tax authorities as an agent of central tax authorities and it is not a proceeding as per Section 6(2)(b) of the WBGST Act.

The order passed above shall not preclude the central tax authorities to proceed in accordance with law and to continue with any proceedings that have been initiated by them.

Parallel proceedings by both Central & State tax authorities cannot be initiated at the same time for the same matter

Petitioner: Smt Sonam Berlia (Prop: M/s Arshee Venture)

Respondents: State of Odisha and others

Authority: Orissa High Court

Date: 23rd March, 2021

Case: A search operation was undertaken u/s 67 of the CGST Act by DGGSTI seizing documents and issuing summons. Parallelly, an SCN was issued by Odisha GST Authorities u/s 74 for payment of GST, interest and penalty. The Petitioner appeared before the Odisha GST authority and submitted that since DGGSTI has seized all the documents and records and hence the proceedings initiated by the Odisha GST Authority should be kept in abeyance till the conclusion of the proceedings by DGGSTI. Despite the facts, the Odisha GST Authority passed order u/s 74 for payment of tax, interest and penalty and also u/s 74(9) for alleged wrong availment of ITC for the same amount.

Core Issue: Whether parallel proceedings can be initiated by the Odisha GST Authority at the same time on the same subject? Whether SCN and subsequent Orders issued by Odisha GST Authority valid in law?

Court’s Observation:

Circular dated 5th October, 2018 issued by the CBEC categorically states that if an officer of the Central Tax authority initiates intelligence-based enforcement action against a taxpayer who is administratively assigned to a State Tax authority, then the officers of Central Tax authority shall themselves undertake the investigation and take the case to its logical conclusion and ‘would not transfer the said case to its state tax counterpart’.

The State Tax Authority claim that they did not have knowledge that the Central tax Authority has seized of the matter despite the Petitioner’s submissions before them.

There is also an overlapping of the periods as the period of enquiry of Central Tax authorities are from July 2017 to Sept 2018 and State Tax authorities have issued SCN for April’ 2018.

Judgement: The Court had quashed the SCN and the impugned Orders and directs that till the conclusion of the proceedings initiated by the DGGSTI, no coercive action can be taken against the Petitioner by the State GST Authorities.

Input Services not eligible for refund under Inverted Duty Structure

Petitioner: Union of India & Others

Respondents: VKC Footsteps India Pvt Ltd.

Authority: Supreme Court

Date: 13th September 2021

Case: The Gujarat High Court in the case of VKC Footsteps India Pvt Ltd v Union of India dated 24th July 2020 directed the Government to consider ITC on input services as part of Net ITC for the purpose of calculating refund under Inverted Duty Structure. Whereas, the Madras High Court in the case of Tvl. Transtonnelstroy Afcons Joint Venture v Union of India dated 21st September 2020 gave a contrary judgement.

Core Issue: Divergent judgement of both the High Courts formed the subject matter of the appeal.

Court’s Observation:

The Gujarat High Court, having examined the provisions of Section 54(3) and Rule 89(5) held that the latter was ultra vires. It also held that by prescribing a formula in Rule 89 (5) to execute refund of unutilized ITC accumulated on account of input services, the delegate of the legislature had acted contrary to the provisions of Section 54(3) which provides for a claim of refund of any unutilized ITC. The Gujarat High Court noted the definition of ITC in Section 2(62) and held that Rule 89(5) by restricting the refund only to input goods had acted ultra vires Section 54(3).

The Madras High Court, on the other hand, declined to follow the view of the Gujarat High Court noting that the proviso to Section 54(3) and, more significantly, its implications do not appear to have been taken into consideration except for a brief reference.

Section 54(3) with its proviso is a complete code which allows refund only on inputs where Input rate is higher than rate on output supplies.

Rule 89(5) which provides for availing ITC on inputs does not transgress the statutory restriction in proviso (ii) to Section 54(3).

The Court affirm the view of the Madras High Court and disapprove of the view of the Gujarat High Court.

Judgement:

The appeals filed by the assessees against the judgment of the Madras High Court shall stand dismissed.

The formula prescribed in Rule 89(5) is not perfect as it seeks to deduct the total output tax from only one component of the ITC, namely ITC on input goods and not on input services. The formula tilts the balance in favour of the Revenue by reducing the refund granted. The practical effect of the formula might result in certain inequities.

The Court strongly urged the GST Council to reconsider the formula and take a policy decision regarding the same.

Loss of Input in manufacturing process is not covered u/s 17(5)(h)

Petitioner: M/s ARS Steels & Alloy International Pvt Ltd.

Respondents: State Tax Officer, Tamil Nadu

Authority: Madras High Court

Date: 24th June 2021

Case: The petitioners are engaged in manufacture of MS Billets & Ingots. MS Scrap is an input in the manufacture of MS Billets and the latter in turn constitutes an input for manufacture of TMT / CTD Bars. There is a loss of a small portion of the inputs, inherent to the manufacturing process. The impugned orders seek reversal of a portion of the ITC claimed by the petitioners, proportionate to the loss of the input, referring to the provisions of Section 17(5)(h) of the GST Act.

Core Issue: Whether reversal of ITC is contemplated in relation to loss arising from manufacturing process?

Court’s Observation:

The situations as set out in clause (h) indicate loss of inputs that are quantifiable, and involve external factors or compulsions. A loss that is occasioned by consumption in the process of manufacture is one which is inherent to the process of manufacture itself.

In the case of Rupa & Co. Ltd. Vs. CESTAT, Chennai, the Division bench decided that some amount of consumption of the input was inevitable in the manufacturing process. It held that Cenvat Credit should be granted on the original amount of input used notwithstanding that the entire amount of input would not figure in the finished product.

Judgement: Reversal of ITC u/s 17(5) (h) by the Revenue in case of loss of input by consumption which is inherent to manufacturing process is misconceived as such loss is not covered by the situations adumbrated u/s 17(5)(h).

Mis-classification of goods cannot be a ground for detention

Petitioner: Asahraf Ali K.H.

Respondents: Assistant Tax Officer, Assistant Commissioner & Joint Commissioner, Kerala GST Department

Authority: Kerela High Court

Date: 13th October, 2020

Case: The Respondents have detained a consignment of goods being transported on the ground that there was misclassification of the goods transported and issued notice to the Petitioner.

Core Issue: Whether mis-classification of goods can be a ground for detention of consignment u/s 129?

Court’s Observation:

If there is misclassification of goods, then the Respondents shall prepare a report on the basis of physical verification and get it signed by the Petitioner after recording his objections. Thereafter a copy of the report shall be sent to the Assessing Officer of the Petitioner to consider the report and the objections at the time of finalizing the assessment.

Detention of goods in transit is not justified.

Judgement:

Mis-classification of goods cannot warrant detention of goods u/s 129.

The Court quashed the notice and directed the respondents to release the goods and the vehicles after getting the petitioner signature/objections recorded on the report prepared by the respondents.

The gist of the Order shall be communicated to the Respondents for expeditious clearance of the goods and the vehicle.

Things include Cash for the purpose of Section 67(2)

Petitioner: Smt Kanishka Matta, w/o Shri Sanjay Matta (Prop: M/s S.S.Enterprises)

Respondents: Asst Director, DGGSTI, Indore and Sr. Intelligence Officer, DGGSTI, Indore

Authority: Madhya Pradesh High Court

Date: 26th August 2020

Case: M/s S.S.Enterprises is in the business of Confectionery and Pan Masala items. The Asst Director, DGGSTI and Sr. Intelligence Officer, DGGSTI conducted a search operation at the business premises as well as residential premises of the Petitioner where they seized unaccounted cash of Rs. 66,43,130/- from the petitioner. The petitioner argued that the respondent does not have the power to seize cash as it does not fall within the definition of “documents or book or things” u/s 67(2) of the CGST Act, 2017.

Core Issue: Whether the expression “things” cover cash or not?

Court’s Observation:

The Court observed that a conjoint reading of Section 2(17), 2(31), 2(75) and 67(2) makes it clear that money can also be seized by authorized officer.

The Court also referred to Black’s Law Dictionary, 10th Edition and Wharton’s Law Lexicon. Wharton’s Law Lexicon defines “thing” as to include money.

Reference was placed to Para No. 12 of the Supreme Court judgement in the case of D.Vinod Shivappa Vs. Nanda Belliappa:

“It is well settled that in interpreting a statute the court must adopt that construction which suppresses the mischief and advances the remedy.”

Judgement: Keeping in view the aforesaid interpretation of the word “thing” money has to be included. The authorities have rightly seized the amount from the husband of the petitioner and unless and until the investigation is carried out and the matter is fully adjudicated, the question of releasing the amount does not arise.

Amount contributed to RWA in excess of Rs. 7,500/- taxable under GST Act

Petitioner: Resident Welfare Associations (RWA) and an individual residing in an apartment

Respondents: Pr. Chief Commissioner of GST & Central Excise, Asst Commissioner of Central Excise & Service Tax & Tamil Nadu Authority for Advance Ruling

Authority: Madras High Court

Date: 1st July 2021

Case: Writ Petitions were filed to quash Circular No. 109/28/2019-GST dated 22.07.2019 and Order No. 25/ARA/2019 dated 21.06.2019 as illegal, arbitrary and ultra vires the Constitution of India and provisions of CGST Act, 2017. An exemption was granted to contributions made to RWA upto an amount of Rs. 7500/- per month per member for sourcing of goods and services from a third person for the common use of the members of RWA.

Core Issue: Where contribution exceeded Rs. 7,500/- the residents would lose the entire entitlement to exemption or the exemption shall continue upto Rs. 7,500/- and only the difference would be eligible to tax?

Court’s Observation:

The Court observed that there is no ambiguity in provisions granting exemptions and it is only a question of interpreting the same.

The term ‘upto’ hardly needs to be defined and connotes an upper limit. It is interchangeable with the term ‘till’ and means that any amount till the ceiling of Rs.7,500/- would exempt for the purposes of GST.

The conclusion of the AAR, as well as the Circular to the effect that any contribution above Rs.7,500/- would disentitle the RWA to exemption, stand quashed.

Judgement: It is only contributions to RWA in excess of Rs.7,500/- that would be taxable under GST Act.

Mandatory to issue Show Cause Notice before quantifying Interest Demand and attaching Bank Account

Petitioner: M/s LC Infra Projects Pvt Ltd

Respondents: Union of India, Department of Finance, Karnataka & Superintendent of CGST, Karnataka

Authority: Karnataka High Court

Date: 22nd July 2019

Case: Some of the suppliers of the Petitioner didn’t upload their Invoices and filed their returns resulting in mismatch in ITC. The Respondent contended that there was an excess availment of ITC. The petitioner was levied tax on the unpaid tax without issuing Show Cause Notice (SCN) and therefore Demand Notice was issued for the tax and interest. The Respondent, thereafter, attached Bank Account.

Core Issue: Can the Respondent quantify interest and attach bank account before issuing SCN u/s 73?

Court’s Observation:

Section 73 states that where it appears to the proper officer that tax has been not paid or short paid or erroneously refunded, or where ITC has been wrongly availed or utilized for any reason, other than by reason of fraud, etc; the officer shall serve notice requiring him to show cause as to why he should not pay the amount along with interest u/s 50 and penalty.

Issue of SCN is sine qua non (i.e., mandatory) to proceed with the recovery of interest and penalty.

Determination of interest payable without issuing SCN is in breach of principles of natural justice.

There is a lapse on the part of the Respondents by not issuing notice before attaching Bank Account.

The notion of the Respondent that Section 75(12) of the Act empowers the authorities to proceed with recovery without issuing SCN is misconceived. Section 75(12) is applicable only to the self-assessment made by the assessee and not to quantification or determination made by the Authority.

Judgement:

The Court had quashed the impugned Order.

The action of the respondent is perverse and illegal and the same deserves to be set aside.

Mandatory to issue Show Cause Notice before quantifying Interest Demand

Petitioner: Godavari Commodities Ltd

Respondents: Union of India, Deputy Commissioner & Superintendent, CGST

Authority: Ranchi High Court

Date: 3rd December 2019

Case: The petitioner was served with an intimation for payment of Rs 11,58,643/- as interest for not depositing the tax within time and to submit the payment details within three days of the date of receipt of the letter. The bank account of the petitioner was freezed and after the payment was made, the bank account was de-freezed.

Core Issue: Whether the action of the Respondent is illegal by not serving show cause notice before issuing the letter and whether provisions of Section 73(1) in relation to tax not paid shall apply?

Court’s Observation:

A plain reading of Section 73(1) shows that this provision is applicable in cases where tax has not been paid for reasons other than fraud.

Since tax was not paid by the petitioner company within the due date; it is a case of tax not been paid and accordingly provisions of Section 73(1) shall apply and it is mandatory to issue Show cause Notice and adjudicate the matter.

Even otherwise, before taking any penal action, irrespective of the fact that whether there is any provision in law or not, the principles of natural justice should be followed.

Therefore, the letter issued for payment of interest is treated as Show cause Notice u/s 73(1) and the matter shall be adjudicated. If upon adjudication it is found that the petitioner was not liable to pay the interest, it shall be refunded with statutory interest thereon.

Judgement: Provisions of Section 73(1) shall be applicable since tax was not paid within due date. The Court directed the adjudicating authority to pass the Order within 3 months of the date of Court’s Order.

Optotax is a Technology Platform Trusted by 50,000+ Tax Professionals across the Country for their 1 Million+ Clients.

Optotax is India’s No. 1 GST Platform and is Exclusively Free for all Tax Professionals.

Our mission is to Empower Tax Professionals and Simplify their practice.

To achieve our mission, we provide a single platform where the Tax Professionals can manage their compliance work in a simplified manner and also gets the opportunity to learn and upgrade knowledge with the help of knowledge-sharing webinars conducted by the best faculties across the country, Taxation related updates, Newsletters, Blogs, Articles, etc.