Everything you need to know about the IGST Exemption on Import of COVID-19 Relief Items

CA. Ramya C

On account of the second wave of COVID-19, the Government has granted exemption from Basic Customs Duty (BCD) and IGST on the import of COVID relief items.

A. On what goods is the Exemption Applicable?

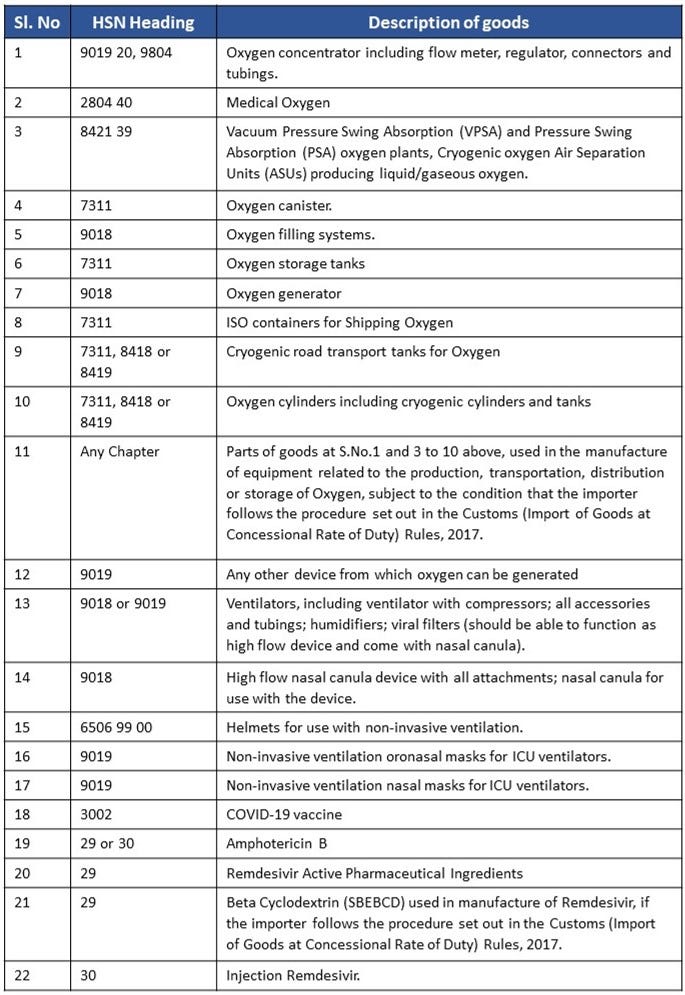

Import of the following goods are eligible for the exemption:

(Ref: Notification No. 28/2021-Customs, 29/2021-Customs, and 31/2021-Customs)

B. Till when is the Exemption available?

The exemption on the specified COVID-19 relief goods has been extended to 31st August 2021. However, it may be noted that exemption for the following goods will be available till 31st October 2021, as per Notification No. 27/2021-Customs dated 20th April 2021:

Remdesivir Active Pharmaceutical Ingredients

Beta Cyclodextrin (SBEBCD) used in the manufacture of Remdesivir, subject to the condition that the importer follows the procedure set out in the Customs (Import of Goods at Concessional Rate of Duty) Rules, 2017.

Injection Remdesivir.

C. What are the conditions to be fulfilled to claim IGST Exemption?

Notification No. 32/2021-Customs specifies the conditions to be fulfilled in order to claim IGST exemption on import of specified COVID relief items. The conditions are as follows:

The goods imported shall be donated to the Central Government or State Government or, on the recommendation of State authority, to any relief agency, entity, or statutory body

The donation shall be for free distribution of such items

The import can either be done free of cost or with payment (It may be noted that prior to the decision taken in the 43rd GST Council Meeting, i.e. up to 31st May 2021, the exemption was available only if the import was done free of cost)

D. What is the Procedure to be followed to avail Exemption?

The importer shall obtain a Certificate from the Central Government or the Nodal Authority (appointed by State Government) mentioning that the imported goods are meant for free distribution for COVID relief.

The said Certificate shall be submitted to the Deputy or Assistant Commissioner of Customs before clearance of goods from the Customs port.

The Importer shall submit the following to the Deputy or Assistant Commissioner within 6 months of the date of import (or such extended date as notified):

a. Certificate from the Central/State Government that the imported goods were received by them for free distribution

b. A statement containing details of goods distributed free of cost, duly certified by the Nodal Authority, in case the goods were donated to a relief agency.

NOTE: In order to access the list of Nodal Authorities appointed by the States, click on the below link:

E. Whether the Certificate issued for every consignment?

The CBIC has clarified in its FAQs dated 7th May 2021 that although a certificate is required to be produced by the importer to Customs at the time of clearance of each consignment, a separate, consignment-wise certificate is not necessary.

A certificate issued to a relief agency may cover goods imported under multiple consignments. The certificate should specify port-wise anticipated import by the relief agency.

F. If the goods are imported in Mumbai but is donated for free distribution in Hyderabad, the Nodal Authority of which State is required to issue Certificate?

Any ‘relief agency’ authorized by a State can make free distribution of goods so imported anywhere in India. Exemption order only envisages that relief agency should have been authorized by a State and should have obtained a Certificate to this effect.

Thus, in the instant case, either of the States of Maharashtra or Telangana may authorize the agency and issue the certificate for compliance of conditions mentioned in Adhoc Exemption Order No. 4/2021-Cus read with 5/2021-Cus dated 31st May 2021. [Ref: CBIC FAQs dated 3rd May 2021]

Optotax is a Technology Platform Trusted by 50,000+ Tax Professionals across the Country for their 1 Million+ Clients.

Optotax is India’s No. 1 GST Platform and is Exclusively Free for all Tax Professionals.

Our mission is to Empower Tax Professionals and Simplify their practice.

To achieve our mission, we provide a single platform where the Tax Professionals can manage their compliance work in a simplified manner and also gets the opportunity to learn and upgrade knowledge with the help of knowledge-sharing webinars conducted by the best faculties across the country, Taxation related updates, Newsletters, Blogs, Articles, etc.